As media inflation rises and consumer journeys scatter, efficiency comes from activating high-intent channels beyond the walled gardens.

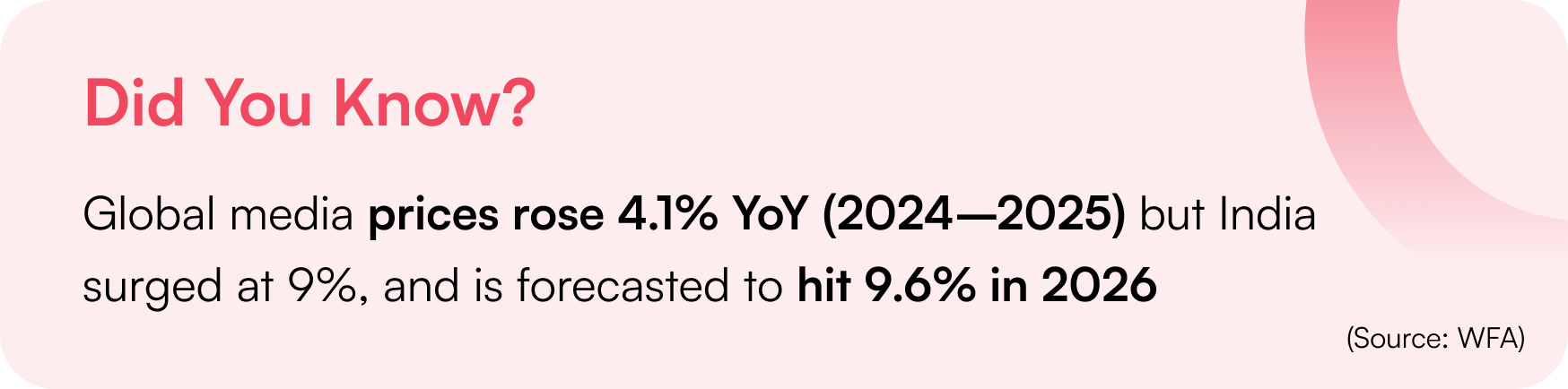

Marketers are entering 2026 with new goals, new KPIs, and new optimism, but not necessarily new money. While marketing budgets are increasing, they aren’t keeping pace with the rising cost of advertising. Media inflation continues to outpace spend growth, especially across the channels that brands have historically relied on the most: search and social.

For the last decade, these walled garden giants have been the default answer to every marketing need from awareness to retention. That default has created an overconcentration of spends in platforms only to make them more expensive, more saturated, and less efficient.

Consumer behaviour today has evolved far beyond these environments. People spend more time on their phones, but not necessarily inside search or social feeds. They’re navigating device surfaces, browsing native apps, exploring app stores, or simply unlocking their screens dozens of times a day. The modern consumer journey is happening in micro-moments that search and social rarely capture.

The challenge for marketers in 2026 isn’t squeezing more from the same channels, it’s diversifying their mix to spend smarter and still drive results incrementally.

The Hidden Cost of Overdependence on Walled Gardens

Between 2020 and 2025, global ad spends surged by more than 50%, with digital channels accounting for over 75% of that growth. But most of this investment flowed into a very small number of dominant platforms, primarily two. What once looked like a balanced media mix gradually narrowed into a strategy heavily concentrated in search and social, two environments that are now more competitive, more expensive, and less efficient than ever.

In 2026, this playbook simply doesn’t hold up. Search and social are experiencing:

- Extreme competition

- Rising CPMs and CPCs

- Data limitations

- Ad fatigue and shrinking attention

Consumers today spend time across a wide range of surfaces – AI tools, app stores, content sites, retail media platforms, fintech ecosystems, utility-led apps, and the device itself. These surfaces, still largely untapped, are often less saturated, less ad-fatigued, and far more aligned with real consumer behaviour. Many brands simply overlook them because search and social feel familiar, and these newer platforms can seem complex.

While the complexities of aligning every channel in your ad journey cannot be denied, especially because these environments require premium partnerships with apps and device manufacturers, brands can turn to DSPs and marketing platforms that already have these integrations. They can unify these channels, simplify activation, and streamline measurement. This means the barrier to diversification is lower than ever, while the upside is higher than ever.

In short, the problem isn’t that walled gardens are ineffective; it’s that they’re no longer enough on their own. The brands outperforming in 2026 are the ones rebalancing their mix toward high-intent, high-impact environments that can deliver incremental reach and more efficient outcomes without requiring disproportionate spend.

Expanding your marketing mix with a hidden new high-ROI channel

Consumers unlock their smartphones over 100 times per day. Yet despite this volume of activity, most marketing plans still target only a fraction of those interactions, primarily the moments spent inside social apps or search engines. Meanwhile, users devote substantial time to native apps, app stores, device search, utility tools, notification panels, and app-to-app journeys. These environments are high intent by nature, but historically difficult for marketers to reach.

OEM and smartphone-native advertising changes that.

How OEM Advertising can make your budget spends more efficient

OEM channels give brands access to high-visibility, high-intent touch points across the entire device journey:

- App Store placements reaching users exploring new apps

- On-device discovery feeds that surface before users enter apps

- Pre-install opportunities for app discovery at device setup

- On-unlock moments with near-guaranteed visibility

- Native app ecosystems with utility-based engagement

These are high-attention moments when users are actively exploring, not passively scrolling. As a result, OEM advertising is uniquely positioned to deliver lower CACs, higher ROI, increased incremental reach, and more meaningful engagement across the funnel.

What a high-intent Marketing Ecosystem looks like in 2026

- Search + Social – Capture existing demand

- AI Tools – Real-time creative, bid and audience optimisation

- Utility Apps (Retail, Fintech, Streaming) – Context-led engagement, mid-funnel reinforcement

- OEM / Device-level Surfaces – micro-intent: unlock navigation, app discovery, installs

Brands finally gain the ability to diversify not for the sake of variety but for genuine performance uplift.

On-device Ads: A Smarter Path to Omnichannel with Less Spend

The future of efficient marketing isn’t about abandoning search and social, they remain essential. It’s about right sizing their roles and building a more complete ecosystem around them.

By incorporating smartphone-native environments, brands unlock a more complete omnichannel journey.

Let search continue to capture existing demand and social a powerful engine for storytelling. But OEM surfaces capture exploration, navigation, and device-level intent that traditional media channels simply cannot. Paired with mid-funnel channels like utility apps, content sites and ecommerce platforms, these touches create a connected journey that drives stronger performance without increasing total spend.

VEVE, a branding and marketing platform specialised in on-device ads and core agency partner to vivo, OPPO and Xiaomi, gives marketers access to premium, high-attention device surfaces that reach millions of users. VEVE helps brands integrate OEM surfaces seamlessly into their media mix, giving them access to:

- Trusted OEM partners

- Inventory across millions of devices (Samsung, Apple, Motorola more)

- Unified measurement frameworks

- High-intent placements aligned with user behaviour

- Dedicated optimisation tools built for efficiency

Across categories like fintech, ecommerce, entertainment, and travel, VEVE brand partners have documented 2×-3× increases in sales, app installs, and conversions after integrating OEM advertising alongside search and social. Read their full case study below:

2026 Is the Year of Smarter Media

Search and social will continue to play important roles in every brand’s media strategy, but relying on them as the sole engines of growth is no longer sustainable.

As competition intensifies and acquisition costs climb, marketers must look beyond the walled gardens and build a smarter, more balanced ecosystem; one that reaches consumers in the moments where intent actually lives.

That shift begins with rebalancing budgets toward smartphone-native environments, where users spend most of their time yet encounter far fewer ads than in traditional channels.

The message for 2026 is clear: To do more with the same budget, you expand to better channels that complement your existing marketing mix.

VEVE gives brands access to the most overlooked, highest-intent ad surfaces in digital marketing today. By bringing OEM and smartphone-native moments into the media mix, brands unlock the next frontier of efficiency, growth, and performance.

To learn more about VEVE’s OEM advertising ecosystem and how it can power your 2026 growth goals, visit our website.